Buyer Intent Data: How to Use It in ABM

In Account-Based Marketing, success is all about targeting the right accounts at the right time.

Buyer intent data provides the insights you need to do just that.

Without it, you’re left guessing when and why accounts are ready to engage, leading to wasted resources and missed opportunities.

In this article, you’ll learn the key differences between first-party and third-party intent data, how to capture them with tools like Clay, and how to leverage HubSpot to act on these insights.

I’ll show you specific examples of using intent data in ABM, so you can see how it works in action.

All that to make your ABM programs in HubSpot more targeted, timely, and effective.

Table of Contents

What is Buyer Intent Data?

Buyer intent data reveals when a company is actively researching solutions in your category based on their online behavior.

It’s the aggregated information you collect from buying signals—known and anonymous actions that prospects take in digital.

These range from your pricing page visits to content downloads from third-party sites.

Think of these actions as your early warning system. Instead of waiting for accounts to raise their hands, you spot the signals that indicate they're in the market.

What makes intent data valuable for ABM? It solves the two biggest challenges:

-

Targeting— Filter your TAL to accounts that not only have a good fit, but also high intent

-

Timing — Reach out to accounts when they’re actively researching or engaging with category-related content.

But here's a warning:

Don't chase every intent signal. False positives (accounts mistakenly flagged as high-intent) will burn out your sales team and kill trust in your system. Focus on high-confidence signals tied to real buying behavior.

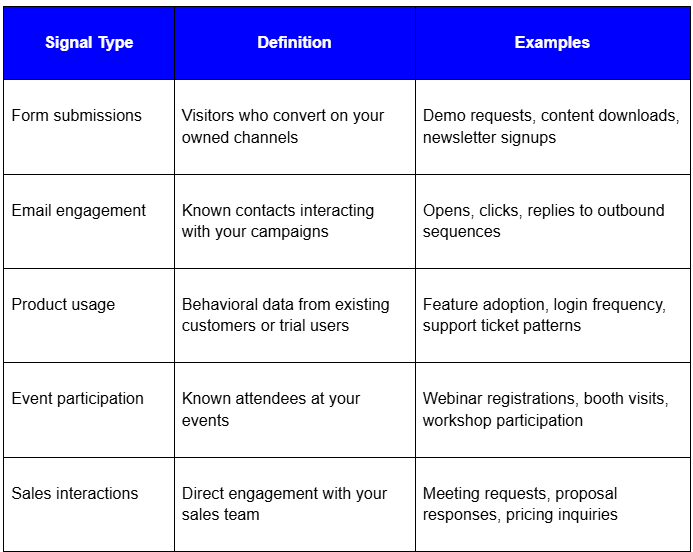

Types of Buyer Intent Data

Think of intent data like a spectrum: from anonymous company-level signals to known individual actions.

Each type serves a different purpose in your ABM strategy.

Known 1st-Party Intent Data

1. Prospects voluntarily give you their information by filling out forms on your website.

2. Known contacts in the CRM engage with your content.

You know exactly who they are, what they downloaded, and when they did it.

(Examples of known 1st party buyer intent data)

Bonus tip: Layer first-party signals with account-level intelligence. A content download from a Champion at a target account is more valuable than one from a cold prospect.

Anonymous 1st-Party Intent Data

1. Visitors' IP addresses are identified and mapped to their company name when they visit your website. You can do it natively with HubSpot or website identification tools like Leadfeeder or Albacross.

2. LinkedIn ads data are matched to CRM accounts through Fibbler.

Remember: You cannot tell which individual within the targeted company is engaging with the content or doing the research; you only see behaviour at the account level.

(Examples of anonymous 1st-party buyer intent data)

Pro tip: Anonymous first-party data is perfect for account-level scoring. Track which target accounts are showing sustained interest before they convert.

Known 3rd-Party Intent Data

1. Visitors leave their information when filling in a web form on a 3-rd party website.

2. Known contacts are engaging with the industry content on social media.

What makes it valuable: You can identify specific individuals showing interest in your category, even if they haven't engaged with your brand directly.

(Examples of known 3rd-party buyer intent data)

Pro tip: Anonymous first-party data is perfect for account-level scoring. Track which target accounts are showing sustained interest before they convert.

Anonymous 3rd-Party Intent Data

This is when data providers like ZoomInfo or G2 track visitors' IP addresses and map them to their company name as they visit a third-party website.

What it reveals: You know someone at the company is showing buying intent, but you can't identify the specific person.

(Examples of anonymous 3-rd party buyer intent data)

Limitations: General 3rd-party intent data gives you a broad overview of market interest, but it's not enough for effective Account-Based Marketing in HubSpot.

You need to go deeper, tying specific buying triggers to individual target accounts for timely outreach and personalized content.

That's where enrichment tools like Clay come in. You can monitor buying signals for each account on your list: funding rounds, hiring spikes, leadership changes and more.

By tapping into this data, you're handing your SDRs both the "why" and the "when" to reach out, so every conversation starts with genuine relevance.

Your marketing team also gets the insights they need to craft content that speaks directly to each account's current situation.

Collecting Buying Signals with Clay

Think of Clay as your account research assistant on steroids.

This spreadsheet-style enrichment tool lets you pull 3-rd party signals from external sources—job boards, LinkedIn, G2, press releases, and web scraping.

Then, enrich companies and contacts in your database with relevant info.

Here's why this matters: Most sales teams are shooting in the dark, reaching out to accounts based on firmographics and technographics alone.

Clay flips the script, giving them reasons to talk and perfect timing for outreach.

Here's how it works in practice:

Let's say Acme Corp is in your target account list. Clay automatically enriches their profile and discovers:

-

Funding signal: Acme Corp just raised $15M Series B (pulled from press releases)

-

Hiring signal: They're actively recruiting for VP of Sales and 3 Account Executive roles (scraped from job boards)

What this tells you: Acme Corp has a fresh budget, gearing up for aggressive growth.

Your play: Instead of a generic cold email, your rep:

-

Reference their funding round,

-

Congratulate them on their growth trajectory

-

Position your service as the solution for ramping up their new sales reps

Here are the examples of buying intent data you gather with Clay:

(Examples of buying signals you can collect with Clay)

How to Use Buyer Intent Data in ABM

Intent data helps your ABM teams prioritize accounts based on actual buying behavior.

Of course, when used properly.

Here are some practical examples of how to turn those signals into actionable ABM tactics.

Each approach focuses on a specific signal type, giving you a clear execution playbook.

1. Reach Out to Accounts Engaging with Your LinkedIn Ads

|

Data Type |

Signal Type |

|

Anonymous 1-st party intent data |

LinkedIn Ads Engagement |

Instead of guessing which accounts are ready to engage, use LinkedIn ads as a filtering mechanism to identify brand-aware companies for warm outreach.

This ABM play works in three phases:

-

First, push your target account list into LinkedIn Ads and run campaigns only toward those accounts.

-

Then, measure engagement metrics like ad clicks, video views, and post interactions with Fibbler directly in HubSpot.

-

Finally, alert sales reps when accounts hit engagement thresholds and are ready for outreach.

Here’s step-by-step instruction on how to set it up in HubSpot:

Step 1: Create a LinkedIn ad engagement list

-

Navigate to Automation

-

Create a new company-based active list

-

Set the criteria using Fibbler’s properties in HubSpot:

- Ad Impressions greater than or equal to 100

- Ad Engagement greater than or equal to 5

-

Exclude companies already in the pipeline

(Active List in HubSpot: LinkedIn Ads Engagement)

Step 2: Build a workflow with a notification

-

Go to Automation -> Workflows -> Create workflow

-

Pic company-based workflow

-

Choose “Automatically trigger enrollment when filter criteria is met” -> List membership -> LinkedIn Engagement (Fibbler)

-

Send in app notification for “Company owner”

(HubSpot Workflow with sales notification)

Remember: You need to find the right engagement range through trial and error before defining meaningful intent.

Be careful: Fibbler only provides company-level data - the known contacts in your HubSpot might not be the same folks who interacted with your ads. Treat ad engagement as an indicator, not a conversation starter.

2. Follow Up with Webinar Attendees that Match Your ICP

|

Data Type |

Signal Type |

|

Known 1st party intent data |

Webinar attendance |

Webinar attendance gives you a clear first-party signal, but here's what most people get wrong: they treat every attendee like a hot lead.

Big mistake.

Instead, treat it as a discovery layer to identify engaged buyers and start non-salesy conversations around the challenges covered in the webinar.

This ABM play works in two phases:

-

First, segment webinar attendees by job title and company fit against your ICP

-

Then, route only qualified contacts to reps for personalized outreach

3. Engage Accounts Visiting Your Website

|

Data Type |

Signal Type |

|

Anonymous 1st-party intent data |

Website visits |

Your target accounts are currently browsing your website anonymously. Use tools like Leadfeeder or Albacross to uncover which companies are behind those visits, and capitalize on the moment with timely outreach.

The strategy works in three phases:

-

First, track visits from target accounts to high-intent pages using website visitor identification tools

-

Then, set up a HubSpot workflow triggering real-time alerts on Slack/Mail to assigned reps

-

Finally, engage with messaging tailored to the page they viewed

Here's an example from our own Slack of what alerts look like in practice:

(Slack alert for website visits)

4. Run intent-based outreach with signals detected in Clay

|

Data Type |

Signal Type |

|

Known 3rd-party intent data |

Hiring |

Here’s an example of our custom workflow using the “recent hire” signal for ABM outreach.

When a new decision-maker joins a target account, Clay:

-

detects the change

-

runs the account research

-

enriches the profile

-

pushes a lead to HubSpot with insights

(Clay workflow for “recent hire” signal)

In the HubSpot Sales Workspace, the rep sees the lead with the critical info and suggested messaging written by ChatGPT 4.5.

(Sales Workspace in HubSpotl)

(Account research generated by Chat GPT 4.5)

Why it works: The workflow eliminates research overhead, gives account context (not fluff), and equips SDRs with timely talking points.

Best Practices for Account-Based Segmentation

Treat segmentation like a live system, not a one-time setup. Use this checklist to keep it accurate and usable across your account-based marketing workflows in HubSpot.

1. Align on ICP and Segments (Quarterly)

-

Run market research to keep segmentation accurate

-

Run workshops with RevOps, sales and marketing teams

-

Define ICP traits, tiers, and disqualification rules

-

Map buying committees with their jobs-to-be-done, challenges, and product use cases

-

Document everything in the Enrichment Brief

2. Review Lists and Scoring (Monthly)

-

Check conversion and pipeline by segment to identify patterns

-

Categorise accounts based on their stage in the sales funnel for tailored marketing and sales efforts

-

Remove low-engagement or outdated segments

3. Maintain Data Quality (Ongoing)

-

Automate enrichment (via Clay) for customer data to maintain quality

-

Flag missing values via workflows or dashboards

-

Lock critical fields to protect scoring logic

Common Challenges of Buyer Intent Data

When predicting buying intent, every account you evaluate falls into one of four categories:

-

True Positive (TP): High-intent account, correctly labelled

-

True Negative (TN): Low-intent account, correctly ignored

-

False Positive (FP): Low-intent account, incorrectly flagged as high intent

-

False Negative (FN): High-intent account, incorrectly labelled as low intent

In the real world, you won’t hit 100% True Positives and Negatives.

Buying signals are messy, people act unpredictably, and data isn’t perfect.

Your goal is simple: make the system better than random guessing.

Keep adjusting your intent classification based on what happens with your flagged accounts.

Track the conversion rate of accounts flagged as high-intent, then tweak your model to cut down on false alarms.

You're aiming to get better over time, not to be perfect.

Here’s why it matters: imagine you score 100 accounts and 10 buy.

If you flag 30 as “high intent,” you’ve got 20 false positives—that’s wasted outreach, and sales won’t trust your model.

Flip side, if you miss 10 true buyers by labelling them “low intent,” you’re quietly losing pipeline.

Getting this right requires expertise in both technical setup and strategic fine-tuning.

If you're not sure where to start, our team can help.

We specialize in building Clay-to-HubSpot workflows that push high-quality buying signals directly into your CRM, so your sales team gets actionable intel for ABM outreach instead of noise

Is Buyer intent data worth it?

Think of buyer intent data as a flashlight in a dark room. It doesn't tell you exactly who will buy, but it shows you where to look.

Here’s what you need to keep in mind:

-

Mix your signals. First-party data (your site, emails) is gold but limited. Third-party or custom signals broaden your view but add noise. The sweet spot? Layer them—score, weight, and combine—to boost overall accuracy.

-

Design your automation thoughtfully. Pushing every signal into a workflow won’t help unless each trigger is tied to a clear persona, buying stage, and owner. Nail the timing, enrich the context, and route alerts so they land in the right inbox.

-

Use buyer intent to focus, not to qualify. A high intent score points you in the right direction, but it doesn’t replace human validation. SDRs and AEs still need to confirm the fit and need before moving forward.

TL;DR – Key Takeaways for Buyer Intent Data

Early Warning System: Reveals when companies are actively researching solutions in your category based on online behavior—no more waiting for accounts to raise their hands.

Four Data Types to Master:

-

Known 1st-Party: Form fills, email engagement, product usage from identified contact

-

Anonymous 1st-Party: Website visits from identified companies via IP tracking

-

Known 3rd-Party: Contacts engaging with industry content on external sites

-

Anonymous 3rd-Party: Company-level signals from data providers like ZoomInfo

ABM Power Combo: Solves targeting (accounts with good fit AND high intent) and timing (outreach when they're actively researching).

Clay as Research Assistant: Pulls enrichment signals like funding rounds, hiring spikes, leadership changes—gives SDRs both the "why" and "when" to reach out.

Proven ABM Plays:

-

Track LinkedIn ad engagement for warm outreach

-

Follow up with webinar attendees matching your ICP

-

Monitor target account website visits for timely engagement

-

Act on buying signals like “hiring” for relevant conversations

Reality Check: Perfect accuracy is impossible—buying signals are messy, and people act unpredictably. Keep adjusting intent classification based on actual outcomes.

Smart Implementation: Layer first-party data (gold but limited) with third-party signals (broader but noisier).

Bottom Line: Buyer intent data won’t eliminate all uncertainty in your ABM, but when you operationalize it smartly across your CRM, segments, and outreach, it turns ambiguity into opportunity.

.png)